TTML Share Price Target 2024, 2025, 2027, 2030, 2040

If you think about which share will be best for investment in recent times then you should know about TTML Share Price Target. Today in our blog we will explain the basic idea about TTML Share Price Target 2024, 2025, 2027, 2030, 2040. We did the research and took advice from experts to make this blog about the company’s growth, performance, etc.

TTML Share Price Target is a trading share in the share market. In this article, we will discuss the company’s financial growth, the business policy of the company, the shareholding pattern of the company, and the forecast share price yearly. We use expert data and analysis to understand the TTML Share Price Target 2024 to 2040.

What Is Tata Teleservices Maharashtra Limited (TTML) Company?

Tata Teleservices Maharashtra Limited is an Indian Internet Service provider and IT services company established in 1996. The headquarters of the company is situated in Mumbai. In 2009, the company introduced mobile voice calling based on a pay-per-use model.

Overview Of TTML Company

In 1995, the company was founded as Hughes Ispat Limited, and in 2003 the company changed its name to Tata Teleservices (Maharashtra) Limited. As per the report, the TTML Company operates a long fiber optic network which is 132,000 km in length and spread over 70 cities.

| Company Name | Tata Teleservices Maharashtra Limited |

| Market Cap | ₹14,785.96 Crore |

| Face Value | ₹10 |

| Book Value | ₹-98.63 |

| P/B | 0 |

| 52 Week High | ₹110.52 |

| 52 Week Low | ₹65.29 |

| DIV. YIELD | 0% |

Financial Data Analysis Of TTML Company

We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. TTML Share Price Target also depended upon the ratio described below.

| PE Ratio | Return On Assets (ROA) | Return On Equity (ROE) | Current Ratio |

| -11.93 | -97.58% | 0% | 0.05 |

Also Read – Bharti Airtel Share Price Target

History Of TTML Share Price Target From 2024 to 2040

TTML Share is under both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last 1 year’s share growth was +0.87 (1.17%), the last 5 year’s share growth was +71.17 (1,872.89%) and the maximum share growth was +67.63 (921.39%).

TTML Share Price Return percentage was 1.08% in the last 1 year, the last 3 years’ share price return percentage was 70.12%, and the last 5 years’ share price return percentage was 1870.79%. The last 6 month’s share growth of TTML Company hit a lower circuit but it will increase in a very short period. TTML Share always gives a good return to investors. If anyone wants to invest in the share it will be profitable on a long-term basis.

TTML Share Price Target 2024

TTML is a leading player in communication and connectivity solutions that provides services ranging from collaboration, cloud, security, loT, and market solutions. The company also provides a comprehensive portfolio of ICT Services for business services in India under the Tata company named Tata Tele Business Services. The solution of TTML Company enterprises is to maintain business in a flexible, scalable, and secure manner.

| Year | TTML Share Price Target 2024 |

| 1st Price Target | 75.85 |

| 2nd Price Target | 99.96 |

The profit growth of the company was -30.56 % in the last 5 years which became 11.63% in the last 3 years and in the last 1 year, it decreased to -7.35%. The Operating Profit amount was ₹131.25 Crore in March 2023 which became ₹141.25 Crore in March 2024. If we look at the TTML Share Price Target 2024 forecast, the 1st Price Target is ₹75.85 and the 2nd Price Target is ₹99.96.

TTML Share Price Target 2025

In the Telecommunication sector, the company’s earnings amount was ₹1,024.99 Crore in the year 2020-21 and in the year 2021-22, the amount was ₹1,079.83 Crore. TTML Company provides a smart Network and Connectivity to the Internet Leased Line, Smart WAN, Broadband, Ultra Low Latency, Business Wi-Fi, P2P-Leased Line, etc. The company’s EBITDA amount was ₹500 Crore in the year 2020-21, and in the year 2021-22, the amount became ₹479 Crore.

| Year | TTML Share Price Target 2025 |

| 1st Price Target | 101.63 |

| 2nd Price Target | 135.45 |

The Sales Growth of the company was -1.39% in the last 5 years which became 4.53% in the last 3 years and in the last 1 year, it became 7.74%. The Net Sales amount was ₹280.23 Crore in March 2023 which increased to ₹324.96 Crore in March 2024. If we look at the TTML Share Price Target 2025 forecast, the 1st Price Target is ₹101.63 and the 2nd Price Target is ₹135.45.

TTML Share Price Target 2027

The TTML Company also has investments in the Collaboration and Productivity Sector like Google Workspace which is a flexible, innovative, and collaborative suite of digital workspace solutions, Zoom which connects and collaborates a new age unified communication solution, etc. In the year 2010, the TTML Company became the first private telecom operator to launch 3G Services in India.

| Year | TTML Share Price Target 2027 |

| 1st Price Target | 170.12 |

| 2nd Price Target | 200.85 |

The ROCE percentage of the company is good which was -174.52% in the last 5 years the percentage became 45.25% in the last 3 years and in the last 1 year, the percentage increased to 53.85%. As the company is a very old company the Promoter Holding capacity of the company is good which is 74% to 75% which means many good investor wants to invest in the share. If we look at the TTML Share Price Target 2027 forecast, the 1st Price Target is ₹170.12 and the 2nd Price Target is ₹200.85.

TTML Share Price Target 2030

In the year 2015, all Mobile CDMA & GSM customers migrated under the Tata Indicom brand. Tata Teleservices provides solutions to fast-moving consumer goods majorly to HUL. Tata Docomo is partnered with the MNC Banks to provide integrated telecom solutions. Tata Docomo provides 50,000 SME customers in tier 2 cities like Pune, Aurangabad, etc.

| Year | TTML Share Price Target 2030 |

| 1st Price Target | 280.25 |

| 2nd Price Target | 320.96 |

The Total Revenue amount of the company was ₹1,120.90 Crore in March 2023 which became 1,202.96 Crore in March 2024. The Total Operating Revenue was ₹1,107.96 Crore in March 2023 which became ₹1,292.96 Crore in March 2024. If we look at the TTML Share Price Target 2030 forecast, the 1st Price Target is ₹280.25 and the 2nd Price Target is ₹320.96.

Also Read – Zee Entertainment Share Price Target

TTML Share Price Target 2040

TTML Company’s marketing solutions are Toll-Free Services, Call Register Services, Live Chat, Digital Survey, etc. The Internet Of Things (loT) solutions under TTML companies are Asset Tracking, Fleet Tracking, School Bus Tracking, Workforce Tracking, etc. TTML Company bets high on small and medium enterprise solutions and predicts a 25-30% growth rate in the coming year.

| Year | TTML Share Price Target 2040 |

| 1st Price Target | 720.96 |

| 2nd Price Target | 755.54 |

The Total Expenditure amount was ₹150.23 Crore in March 2023 which became ₹183.25 Crore in March 2024. The Current Assets amount was ₹272.52 Crore in March 2023 which becomes ₹292.56 Crore in March 2024. If we look at the TTML Share Price Target 2040 forecast, the 1st Price Target is ₹720.96 and the 2nd Price Target is ₹755.54.

How To Purchase TTML Share?

The most common trading platform for purchasing the TTML Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Peer’s Company of TTML Company

- Bharti Airtel

- Vodafone Idea

- MTNL

- Reliance Comm

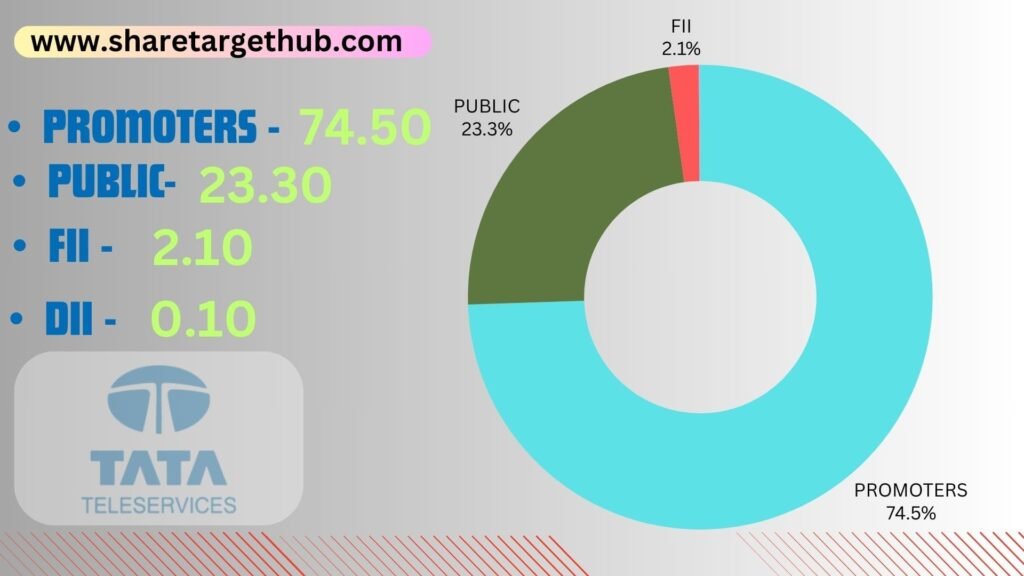

Investors Types And Ratio Of TTML Company

There are mainly four main Types of Investors in TTML Company. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (company owner) through overall capital. TTML Company’s promoter holding capacity is 74.50%.

Public Holding

Public Investors are individuals who invest in the public market for profit in the future (large and small companies). TTML Company’s public holding capacity is 23.30%.

FII

Foreign Institutional Investors are those big companies that invest in different countries company. TTML Company’s FII is 2.10%.

DII

Domestic Institutional Investors (like Insurance, companies mutual funds) who invest in their own country. TTML Company’s DII is 0.10%.

Advantages and Disadvantages Of TTML Share

Every share has some advantages and some disadvantages also. So, the TTML Share Price Target also has some advantages and disadvantages.

Advantages

- The ROCE Percentage of the company is good which is 45.25% in the last 3 years.

- The company has an efficient cash conversation cycle which is 40.68 days.

- The Company has a good promoter holding capacity which is 74% to 75%.

- The company has an effective average operating margin of 43.52% in the last 5 years.

- The cash flow amount of the company is increasing.

Disadvantages

- The Book Value amount of the company is decreasing per share.

- The revenue growth percentage of the company is not good which is 4.53% in the last 3 years.

- The Profit Growth of the company decreased to -7.35% in the last 1 year.

- The Company has a high EBITDA which is 63.62.

Also Read – IRCTC Share Price Target

FAQ

What are the main functions of TTML Company?

Tata Teleservices (Maharashtra) Limited is the leading player in the connectivity and communication sector.

What is the TTML Share Price Target for 2024?

TTML Share Price Target for 2024 is ₹75.85 to ₹99.96.

What is the TTML Share Price Target for 2025?

TTML Share Price Target for 2025 is ₹101.63 to ₹135.45.

What is the TTML Share Price Target for 2027?

TTML Share Price Target for 2027 is ₹170.12 to ₹200.85.

What is the TTML Share Price Target for 2030?

TTML Share Price Target for 2030 is ₹280.25 to ₹320.96.

What is the TTML Share Price Target for 2040?

TTML Share Price Target for 2040 is ₹720.96 to ₹755.54.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about the TTML Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, TTML Price Target may reach a very high position. TTML Company is related to the Tele Communication Sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.